Swedencare - A run-of-the-mill quarter with 400% growth

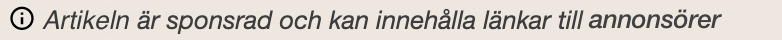

Solid report across the board Optimistic comments around synergies and targets Adj. EBIT estimates up 1-3% Key takes from the Q2’21 report Swedencare’s Q2’21 report was strong, although the company continues to see supply chain issues. Sales grew 45% organically (ABGSCe: 45%) and 400% in total to SEK 160m, 2% below our expectations at SEK 163m. The growth within the group companies is stated to have varied from single digits to almost triple digits, with the companies seeing single-digit growth rates having the most supply troubles – one of the reasons the Vetio acquisition was made.

On the margin, the company reported a 28% adj. EBIT margin, which was above our expectations and resulted in an adj. EBIT beat of 7%.

Outlook: Stronger Vetio performance and faster synergies While we saw no drama in the reported numbers, we have a few key take-aways from the conference call, which has resulted in us raising our ‘23e EBIT by 3%. 1) The Vetio order visibility looks even stronger than we thought, with Vetio North having a higher share of development revenues likely to turn into manufacturing during 2022-2023. On the back of this, we raise our organic growth assumptions for the company by 5pp in H2’22-‘23e to c.

20%. 2) Insourcing synergies are likely to materialise earlier than our initial expectations. On the conference call, management stated that they target 50% of US production to be insourced in 12 months, indicating faster synergies in Rx than our earlier expectations.

On the back of this, we raise our ’21-‘23e sales and EBIT by 0-4% and 1-3%, respectively. 3) The company will review its financial targets during H2. While we believe the margin target is likely to stay, the review could result in a bump to the sales level, which now implies a 20% CAGR on our 2023 estimates.

Trading at 41x EV/EBIT 2023e On our updated estimates, the Swedencare share is trading at a ‘21e-‘23e EV/EBIT of 72-41x. This corresponds to the share trading 35-25% above animal heal.