PepsiCo (PEP) Stock Rallies 7.4% Following Earnings ReportPepsiCo (PEP) Stock Rallies 7.4% Following Earnings Report – What Comes Next?

Yesterday, PepsiCo Inc. (PEP) released its quarterly earnings report, which significantly exceeded market expectations:

→ Earnings per share (EPS) came in at $2.12, surpassing the forecast of $2.02.

→ Gross revenue reach

PepsiCo, Inc.

143.45USDR

−1.06−0.73%

Last update at 23:47 GMT

143.55USD

+0.10+0.07%

No tradesPost-marketLast update at 23:35 GMT

Key facts today

PepsiCo upgraded its earnings forecasts in a recent earnings report, contributing to positive investor sentiment.

Next report date

≈

October 2

Report period

Q3 2025

EPS estimate

2.26 USD

Revenue estimate

23.90 B USD

5.50 USD

9.58 B USD

91.85 B USD

1.36 B

About PepsiCo, Inc.

Sector

Industry

CEO

Ramon Luis Laguarta

Website

Headquarters

Purchase

Founded

1965

FIGI

BBG000DH7JK6

PepsiCo, Inc. is a global food and beverage company. The Company's portfolio of brands includes Frito-Lay, Gatorade, Pepsi-Cola, Quaker and Tropicana. The Company operates through six segments: Frito-Lay North America (FLNA), Quaker Foods North America (QFNA), North America Beverages (NAB), Latin America, Europe Sub-Saharan Africa (ESSA), and Asia, Middle East and North Africa (AMENA). The FLNA segment includes its branded food and snack businesses in the United States and Canada. The QFNA segment includes its cereal, rice, pasta and other branded food businesses in the United States and Canada. The NAB segment includes its beverage businesses in the United States and Canada. The Latin America segment includes its beverage, food and snack businesses in Latin America. The ESSA segment includes its beverage, food and snack businesses in Europe and Sub-Saharan Africa. The AMENA segment includes its beverage, food and snack businesses in Asia, Middle East and North Africa.

5.0%

7.5%

10.0%

12.5%

15.0%

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

0.00

7.00 B

14.00 B

21.00 B

28.00 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

6.00 B

12.00 B

18.00 B

24.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

6.00 B

12.00 B

18.00 B

24.00 B

Q2 '24

Q3 '24

Q4 '24

Q1 '25

Q2 '25

−20.00 B

0.00

20.00 B

40.00 B

60.00 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

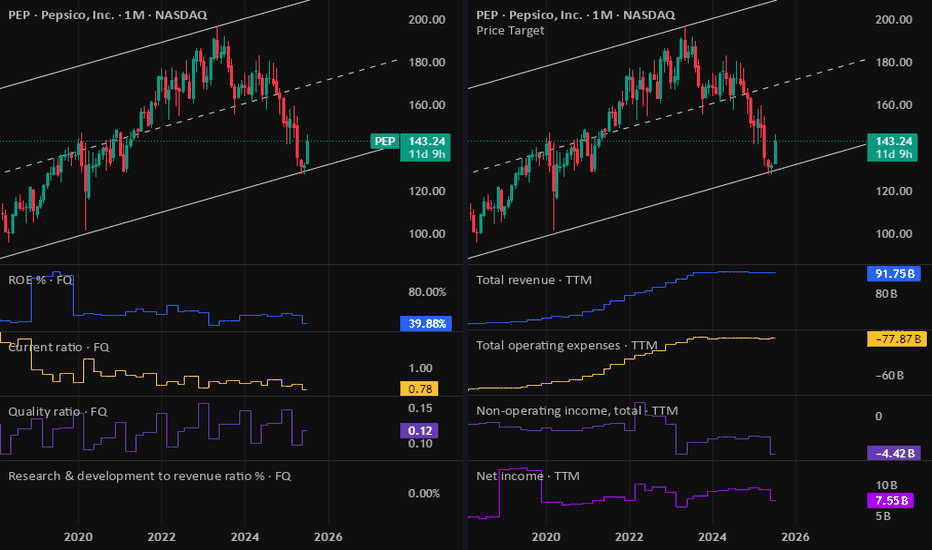

PEPsico is looking to pop up further NASDAQ:PEP had a strong gap up, and with the latest completion of the cup and handle, it is clear that the upside is likely coming back. Bullish engulfing candle was seen as a strong contender for continued upside. My guess is with the positive momentum, the stock is likely to break above the downt

NLong

PEP: PepsiCo Earnings resultsIts looks like PEP is a buy now. Just want to double check on future sales growth as it is stable for a while. Lower stock price made the dividend very attractive since PEP is a defensive stock.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

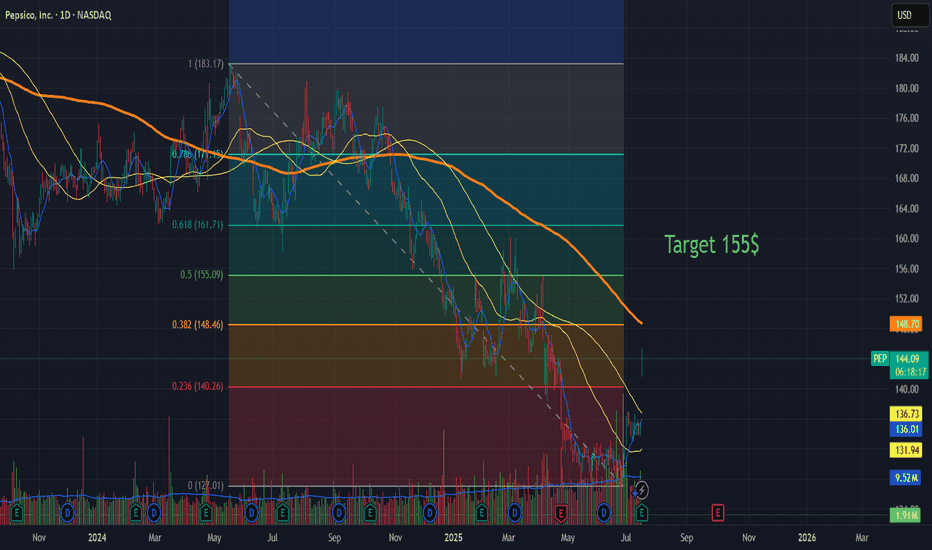

Pepsi can retrace to 155 in short termVery short post:

Pepsi NASDAQ:PEPS had a very good earnings call and based on fb retracement, this will retrace to 155 soon. It has potential to go abive that if the reversal is confirmed.

NLong

PEP is in the Wyckoff Accumulation phaseThis Week (July 8 - 12):

Support: The recent consolidation shelf around $130.00 is the first line of defense. The absolute low and our line in the sand is the Selling Climax low at $127.60.

Resistance: The 20-week moving average at $138.30 is the immediate ceiling it needs to break through.

Next

NLong

NShort

PEP Long-Term Buy Opportunityhi Traders,

The chart presents a compelling long-term buying opportunity for PepsiCo (PEP). The price is currently sitting in the identified "buy zone", a historically reliable area for accumulation. If we experience further dips, it’s still considered a buying opportunity all the way down to the 2

NLong

Update on $PEP: The price finally made its move. Breakout of our Level 0 and confirmed bullish crossover on the daily chart (that is still bearish)

Massive Volume coming.

NLong

[PEP] Pepsi investmentI took my first and main position on NASDAQ:PEP just before this little spike.

My target is very high because I want to hold this stock for a while and maybe I will hold even more than what you see on the graph.

Strong confidence for the long run ...

Great Trade !

NLong

NLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US713448FG8

PEPSICO 21/51Yield to maturity

6.92%

Maturity date

Oct 21, 2051

PEP4895343

PepsiCo, Inc. 2.875% 15-OCT-2049Yield to maturity

6.69%

Maturity date

Oct 15, 2049

PEP4864210

PepsiCo, Inc. 3.375% 29-JUL-2049Yield to maturity

6.54%

Maturity date

Jul 29, 2049

US713448FF0

PEPSICO 21/41Yield to maturity

6.45%

Maturity date

Oct 21, 2041

US713448DP0

PEPSICO INC. 16/46Yield to maturity

6.40%

Maturity date

Oct 6, 2046

PEP4968014

PepsiCo, Inc. 3.625% 19-MAR-2050Yield to maturity

6.33%

Maturity date

Mar 19, 2050

PEP4968015

PepsiCo, Inc. 3.875% 19-MAR-2060Yield to maturity

6.27%

Maturity date

Mar 19, 2060

PEPS

PEPSICO INC. 17/47Yield to maturity

6.19%

Maturity date

May 2, 2047

PEP5447005

PepsiCo, Inc. 4.2% 18-JUL-2052Yield to maturity

6.07%

Maturity date

Jul 18, 2052

PEP3887895

PepsiCo, Inc. 3.6% 13-AUG-2042Yield to maturity

6.07%

Maturity date

Aug 13, 2042

PEPB

PEPSICO INC. 12/42Yield to maturity

6.01%

Maturity date

Mar 5, 2042

See all PEP bonds

Curated watchlists where PEP is featured.

Frequently Asked Questions

The current price of PEP is 143.45 USD — it has decreased by −0.73% in the past 24 hours. Watch PepsiCo, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange PepsiCo, Inc. stocks are traded under the ticker PEP.

PEP stock has risen by 1.98% compared to the previous week, the month change is a 11.90% rise, over the last year PepsiCo, Inc. has showed a −15.36% decrease.

We've gathered analysts' opinions on PepsiCo, Inc. future price: according to them, PEP price has a max estimate of 175.00 USD and a min estimate of 115.00 USD. Watch PEP chart and read a more detailed PepsiCo, Inc. stock forecast: see what analysts think of PepsiCo, Inc. and suggest that you do with its stocks.

PEP stock is 1.49% volatile and has beta coefficient of 0.08. Track PepsiCo, Inc. stock price on the chart and check out the list of the most volatile stocks — is PepsiCo, Inc. there?

Today PepsiCo, Inc. has the market capitalization of 197.85 B, it has increased by 7.53% over the last week.

Yes, you can track PepsiCo, Inc. financials in yearly and quarterly reports right on TradingView.

PepsiCo, Inc. is going to release the next earnings report on Oct 2, 2025. Keep track of upcoming events with our Earnings Calendar.

PEP earnings for the last quarter are 2.12 USD per share, whereas the estimation was 2.03 USD resulting in a 4.50% surprise. The estimated earnings for the next quarter are 2.26 USD per share. See more details about PepsiCo, Inc. earnings.

PepsiCo, Inc. revenue for the last quarter amounts to 22.73 B USD, despite the estimated figure of 22.27 B USD. In the next quarter, revenue is expected to reach 23.90 B USD.

PEP net income for the last quarter is 1.26 B USD, while the quarter before that showed 1.83 B USD of net income which accounts for −31.13% change. Track more PepsiCo, Inc. financial stats to get the full picture.

Yes, PEP dividends are paid quarterly. The last dividend per share was 1.42 USD. As of today, Dividend Yield (TTM)% is 3.80%. Tracking PepsiCo, Inc. dividends might help you take more informed decisions.

PepsiCo, Inc. dividend yield was 3.51% in 2024, and payout ratio reached 76.68%. The year before the numbers were 2.91% and 75.37% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 25, 2025, the company has 319 K employees. See our rating of the largest employees — is PepsiCo, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PepsiCo, Inc. EBITDA is 17.84 B USD, and current EBITDA margin is 19.72%. See more stats in PepsiCo, Inc. financial statements.

Like other stocks, PEP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PepsiCo, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PepsiCo, Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PepsiCo, Inc. stock shows the sell signal. See more of PepsiCo, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.