Interim Report 1 January – 30 September 2025: Dedicare strengthens positioning through strategic initiatives under still-challenging market conditions

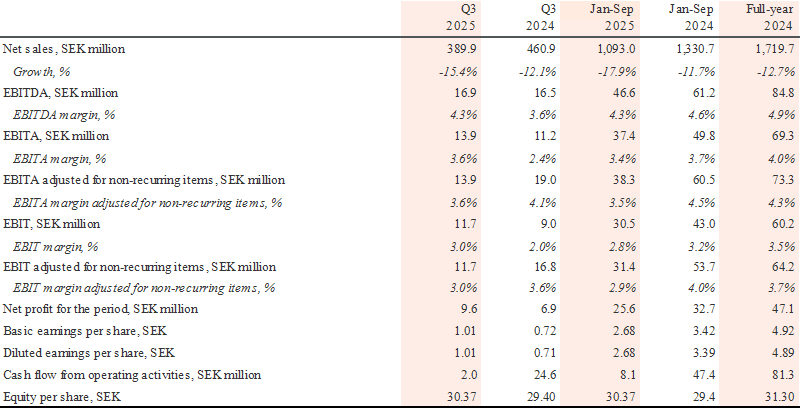

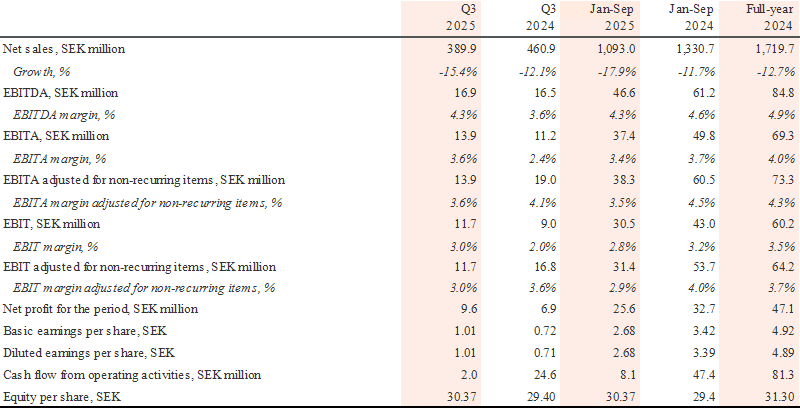

Third quarter 2025

• Net sales SEK 389.9 million (460.9)

• EBITA SEK 13.9 million (11.2), adjusted for non-recurring items SEK 13.9 million (19.0)

• EBITA margin 3.6 percent (2.4), adjusted for non-recurring items 3.6 percent (4.1)

• EBIT SEK 11.7 million (9.0), adjusted for non-recurring items SEK 11.7 million (16.8)

• EBIT margin 3.0 percent (2.0), adjusted for non-recurring items 3.0 percent (3.6)

• Profit after financial items SEK 11.7 million (8.9)

• Profit for the period SEK 9.6 million (6.9)

• Basic earnings per share SEK 1.01 (0.72)

• Diluted earnings per share SEK 1.01 (0.71)

The period January-September 2025

• Net sales SEK 1,093.0 million (1,330.7)

• EBITA SEK 37.4 million (49.8), adjusted for non-recurring items SEK 38.3 million (60.5)

• EBITA margin 3.4 percent (3.7), adjusted for non-recurring items 3.5 percent (4.5)

• EBIT SEK 30.5 million (43.0), adjusted for non-recurring items SEK 31.4 million (53.7)

• EBIT margin 2.8 percent (3.2), adjusted for non-recurring items 2.9 percent (4.0)

• Profit after financial items SEK 31.9 million (42.0)

• Profit for the period SEK 25.6 million (32.7)

• Basic earnings per share SEK 2.68 (3.42)

• Diluted earnings per share SEK 2.68 (3.39)

Performance measures

Chief Executive Officer’s statement

Dedicare strengthens positioning through strategic initiatives under still-challenging market conditions

The healthcare staffing market remained challenging in the third quarter 2025, with persistent price pressure and limited demand. Despite this, Dedicare is reporting stable earnings and continuing to invest in its future. With our initiatives in social care in Denmark through the acquisition of We Care ApS in the quarter, as well as staffing physiotherapists and occupational therapists, and our start-up as a care provider in Norway, we’re expanding our business and sharpening the group’s long-term competitiveness.

The Dedicare group’s net sales were SEK 389.9 million in the quarter, a 15.4 percent decrease on the corresponding quarter of the previous year. The EBITA margin was 3.6 percent (2.4), and 3.6 percent (4.1) adjusted for non-recurring items. This improved margin is largely explained by savings measures implemented. The equity/assets ratio was 51.4 percent at quarter-end, evidence of our strong financial position.

Norway, which makes up over two-thirds of the group’s sales, reported net sales of SEK 262.5 million for the quarter, a 16.5 percent decrease year on year; currency adjusted, the downturn was 13.6 percent. The EBITA margin was 5.6 percent (6.1), with this narrower margin due to the Norwegian krone’s persistent weakness and intense competition.

As evidence of the strong corporate culture we’ve built, Dedicare Norway was named Norway’s Best Workplace for the third consecutive year, while also being ranked Europe’s 17th best workplace by a Great Place to Work.

After a long period of decline, we’re now seeing signs of the market stabilising in Sweden. Net sales were SEK 75.5 million, a marginal 0.5 percent downturn year on year, while EBITA increased to SEK -0.7 million (-2.7).

Our new initiative in physiotherapist and occupational therapist staffing in Sweden is helping expand our offering and consolidate our positioning as a complete partner for the healthcare sector.

Denmark reported net sales of SEK 43.0 million for the quarter, down by 28.0 percent year on year. The EBITA margin was 3.5 percent (8.7) for the quarter. Our business is still being negatively impacted by restrictions on nurse and doctor contracting.

Our acquisition of We Care, an established operator in social care, advances our positioning in a segment offering high potential and stable demand.

In the UK, sales for the quarter were SEK 12.8 million, down 17.3 percent year on year. EBITA was SEK -0.5 million (0.4). This operation is still being negatively impacted by National Health Service (NHS) restrictions, but Dedicare’s diversification and experience in segments including international recruitment mean it has good potential to respond to the change occurring on the market.

Dedicare is well prepared for its future. We’re a financially stable company with an increasingly diverse business and clear strategy for profitable growth. Market conditions remain challenging, with price pressure, limited demand and intense competition in several segments. Meanwhile, the investments we’re making in new segments are helping sharpen our long-term competitiveness. With committed staff, a strong corporate culture and clear strategy, we’re continuing to create value — for our customers, staff and wider society.

I’d like to offer my warm thanks to all our staff for their commitment and professionalism. You’re the foundation of our success and our ability to deliver social benefit even when market conditions are challenging. With our collective competence and strong culture, I’m confident about our future.

Bård Kristiansen, CEO and Managing Director

This information is mandatory for Dedicare AB (publ) to publish pursuant to the EU Market Abuse Regulation (MAR) and the Swedish Securities Markets Act. This information was submitted for publication through the agency of the below contact at 8 a.m. CEST on 23 October 2025

Bård Kristiansen, CEO & Managing Director, +47 97 08 88 83

Anette Sandsjö, CFO, +46 73 343 44 68

About Dedicare

At Dedicare, we’re passionate about adding expertise to healthcare, life science and social work. We’re driven by making a responsible and sustainable contribution to people's health, development and quality of life. Dedicare was founded in 1996 and is the Nordic region's largest recruitment and staffing provider. We have operations in Sweden, Norway, Denmark and in the UK. Dedicare is listed on Nasdaq Stockholm and had sales of SEK 1.7 billion in 2024. Each day, we have about 2,000 employees on assignment. We see Europe as our future market, and in time, our vision is to grow into one of Europe's leading recruitment and staffing providers in healthcare, life science and social work.

Read more about Dedicare at dedicaregroup.com/en/